The Best Guide To Medicare Graham

The Best Guide To Medicare Graham

Blog Article

Medicare Graham Fundamentals Explained

Table of ContentsThe smart Trick of Medicare Graham That Nobody is Talking AboutFacts About Medicare Graham UncoveredNot known Incorrect Statements About Medicare Graham A Biased View of Medicare GrahamExamine This Report on Medicare Graham

Before we talk concerning what to ask, let's speak regarding that to ask. For lots of, their Medicare journey begins directly with , the main website run by The Centers for Medicare and Medicaid Providers.

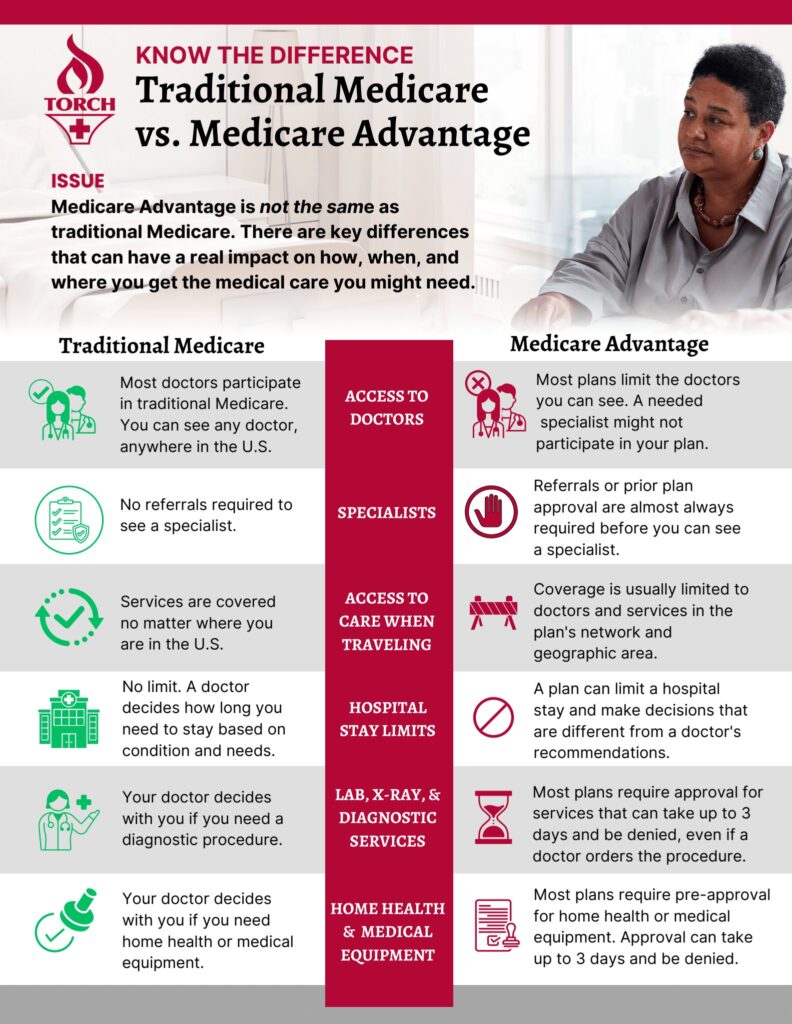

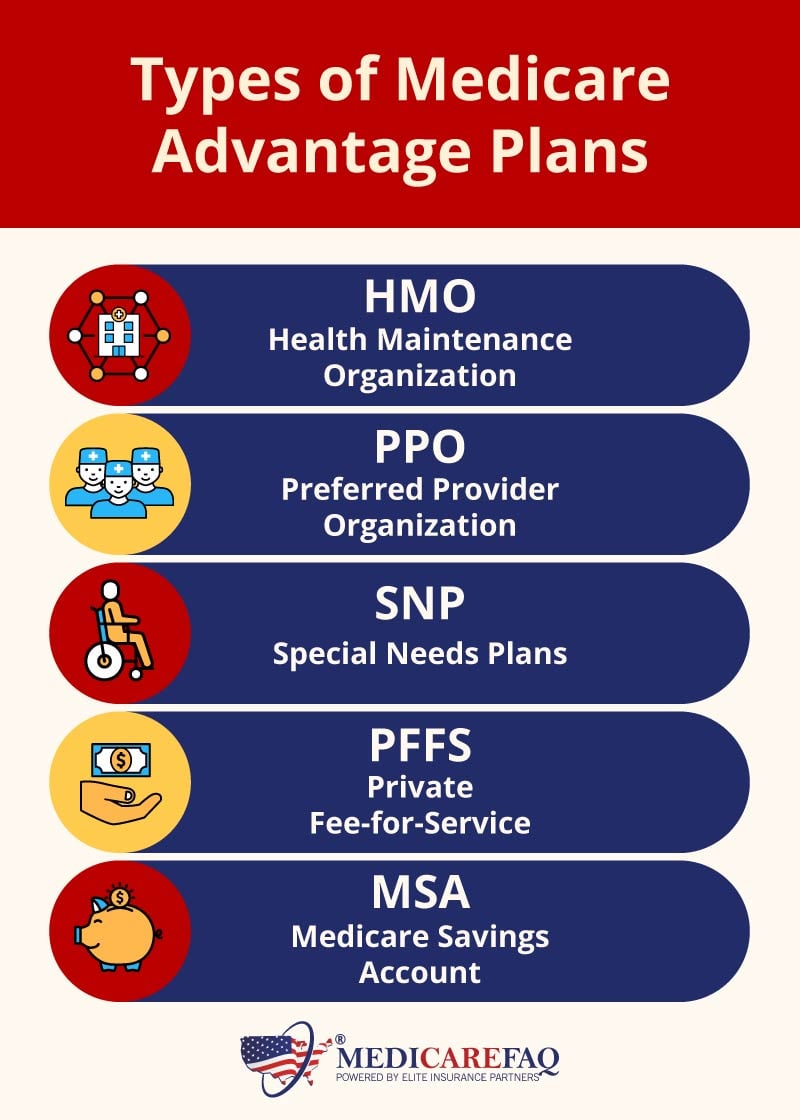

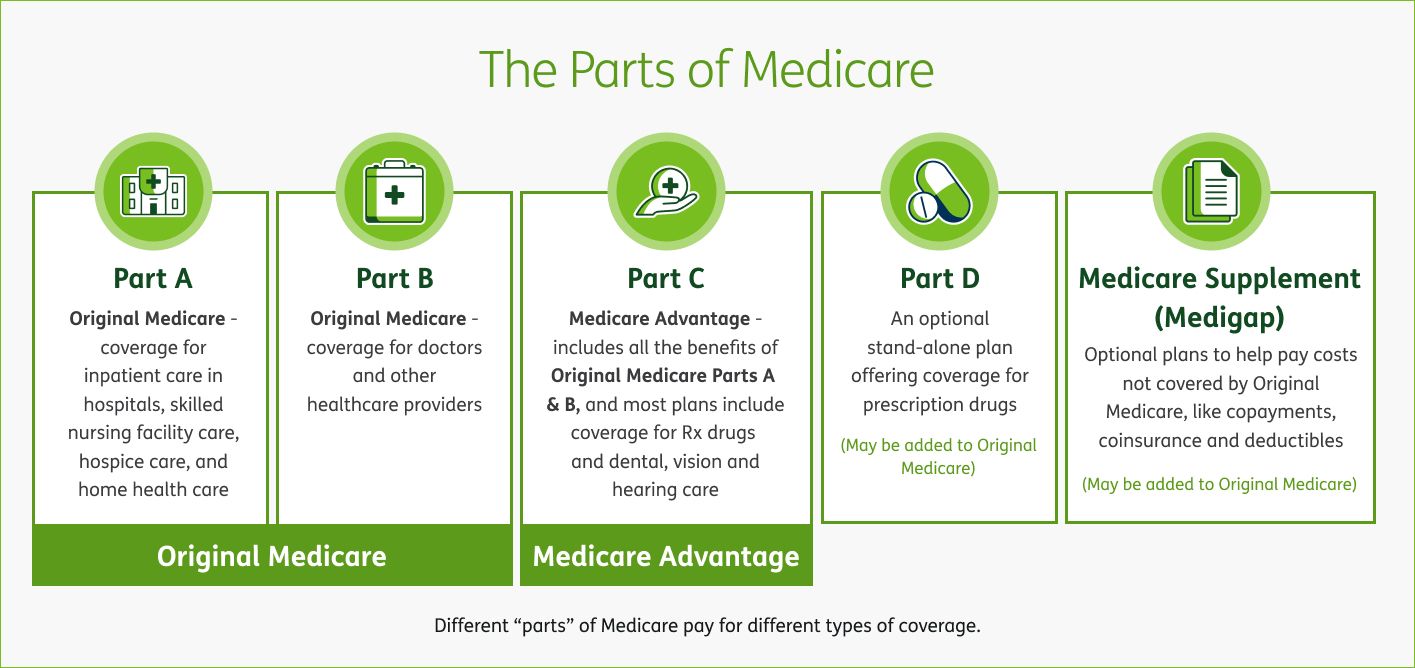

It covers Part A (hospital insurance) and Part B (clinical insurance policy). These plans function as an alternate to Initial Medicare while using more advantages.

Medicare Part D plans aid cover the cost of the prescription medicines you take at home, like your day-to-day medicines. You can register in a separate Component D strategy to add drug insurance coverage to Original Medicare, a Medicare Cost strategy or a few various other kinds of plans. For numerous, this is commonly the first question considered when browsing for a Medicare strategy.

The Ultimate Guide To Medicare Graham

To get the most cost-effective health and wellness treatment, you'll desire all the solutions you use to be covered by your Medicare plan. Your strategy pays whatever.

and seeing a company that approves Medicare. But what regarding traveling abroad? Numerous Medicare Advantage strategies give international coverage, as well as insurance coverage while you're taking a trip domestically. If you prepare on traveling, make sure to ask your Medicare advisor about what is and isn't covered. Possibly you have actually been with your present doctor for some time, and you intend to keep seeing them.

Fascination About Medicare Graham

Lots of people that make the switch to Medicare proceed seeing their routine physician, but also for some, it's not that basic. If you're dealing with a Medicare expert, you can ask them if your doctor will certainly remain in connect with your new plan. However if you're looking at plans individually, you might need to click some web links and make some telephone calls.

For Medicare Advantage strategies and Expense strategies, you can call the insurer to ensure the medical professionals you wish to see are covered by the strategy you're interested in. You can also examine the plan's site to see if they have an on-line search tool to discover a covered medical professional or facility.

Which Medicare plan should you go with? Beginning with a listing of factors to consider, make sure you're asking the right concerns and begin concentrating on what kind of strategy will best serve you and your needs.

Medicare Graham for Dummies

Are you regarding to transform 65 and become freshly eligible for Medicare? The least pricey strategy is not always the finest option, and neither is the most costly plan.

Also if you are 65 and still functioning, it's a great idea to examine your options. People receiving Social Safety advantages when transforming 65 will be immediately registered in Medicare Components A and B. Based upon your employment scenario and healthcare options, you may need to take into consideration enrolling in Medicare.

Original Medicare has 2 parts: Component A covers a hospital stay and Part B covers medical costs.

The Main Principles Of Medicare Graham

There is typically a premium for Component C policies in addition to the Part B premium, although some Medicare Advantage intends deal zero-premium strategies. Medicare Lake Worth Beach. Testimonial the protection details, expenses, and any kind of fringe benefits provided by each plan you're taking into consideration. If you enlist in original Medicare (Components A and B), your premiums and insurance coverage will coincide as various other people that have Medicare

(https://www.tripadvisor.com/Profile/m3dc4regrham)This is a fixed amount you might need to pay as your share of the price for Your Domain Name treatment. A copayment is a fixed amount, like $30. This is one of the most a Medicare Benefit member will need to pay out-of-pocket for protected solutions each year. The amount differs by plan, once you get to that restriction, you'll pay nothing for protected Part A and Component B services for the remainder of the year.

Report this page